Navigating the world of warehouse memberships can feel like a game of hidden numbers, especially when it comes to options like Costco's Executive tier. While the promise of rewards and exclusive perks is alluring, the savvy shopper knows that true value lies in crunching the numbers. This guide isn't just about the math; it's about empowering you to make an informed decision by clearly Calculating Your Breakeven Point for Executive Membership. We'll cut through the marketing speak to help you understand precisely what you need to spend to make that upgrade genuinely pay off.

At a Glance: Your Executive Membership Breakeven Snapshot

- Basic vs. Executive: A Gold Star membership costs $65 annually; Executive is $130. The difference you're trying to justify is $65.

- The 2% Reward: Executive members earn a 2% reward on most qualified purchases.

- Breakeven for the Extra Cost: You need to spend $3,250 annually on qualified items to earn back the additional $65 fee (yielding a $65 reward certificate). That's roughly $271-$300 per month.

- Breakeven for the Full Cost: To cover the entire $130 Executive membership fee solely through the 2% reward, you need to spend $6,500 annually (yielding a $130 reward certificate). This works out to about $542 per month.

- Other Perks Add Value: Consider $10 monthly delivery credits (with conditions), early shopping access (starting 2025), and travel rewards – they can tip the scales.

- Watch for Exclusions: Not all purchases qualify for the 2% reward. Gas, gift cards, tobacco, and more are often excluded.

- Your Action Plan: Review your past year's Costco spending to quickly determine if the Executive membership makes financial sense for you.

Decoding the Costco Executive Membership: What You Get

Before we dive into the calculations, let's establish a clear picture of the Executive membership. It's Costco's premium tier, designed for frequent shoppers who can maximize its benefits. At an annual cost of $130, it's double the $65 annual fee of the standard Gold Star or Business membership. But what exactly do you get for that extra $65?

The Cornerstone Benefit: A 2% Annual Reward

The most significant and often most-touted perk of an Executive membership is the annual 2% reward on qualified purchases. This reward is issued as a certificate that arrives with your annual renewal notice and can be redeemed for merchandise at Costco warehouses. It's important to note there's a maximum reward of $1,250 per year. To hit that impressive cap, you'd need to spend a whopping $62,500 annually—a target most individual households won't reach, but certainly achievable for small businesses or very large families.

Beyond the Cash Back: Exclusive Perks and Advantages

While the 2% reward is the star, Executive membership comes with a few other notable benefits that can add significant value, depending on your shopping habits:

- Delivery Credits: Executive members receive a $10 monthly credit, totaling $120 annually. This credit is applicable to orders of $150 or more placed through Costco Same Day Delivery or Costco via Instacart. While seemingly straightforward, remember the minimum order requirement; if you rarely hit that threshold, this benefit might not be as useful.

- Early Shopping Access (Coming 2025): Starting in 2025, Executive members will gain exclusive access to early shopping hours. For those who dread crowded aisles, this could be a game-changer, offering a more serene shopping experience and first pick of popular items.

- Costco Travel Rewards: Travel booked through Costco Travel also qualifies for the 2% reward. If you frequently book vacations, cruises, or rental cars through Costco, these expenditures can significantly boost your annual reward certificate.

Understanding these benefits is the first step toward accurately Is the Executive Membership worth it? for your specific lifestyle and spending habits.

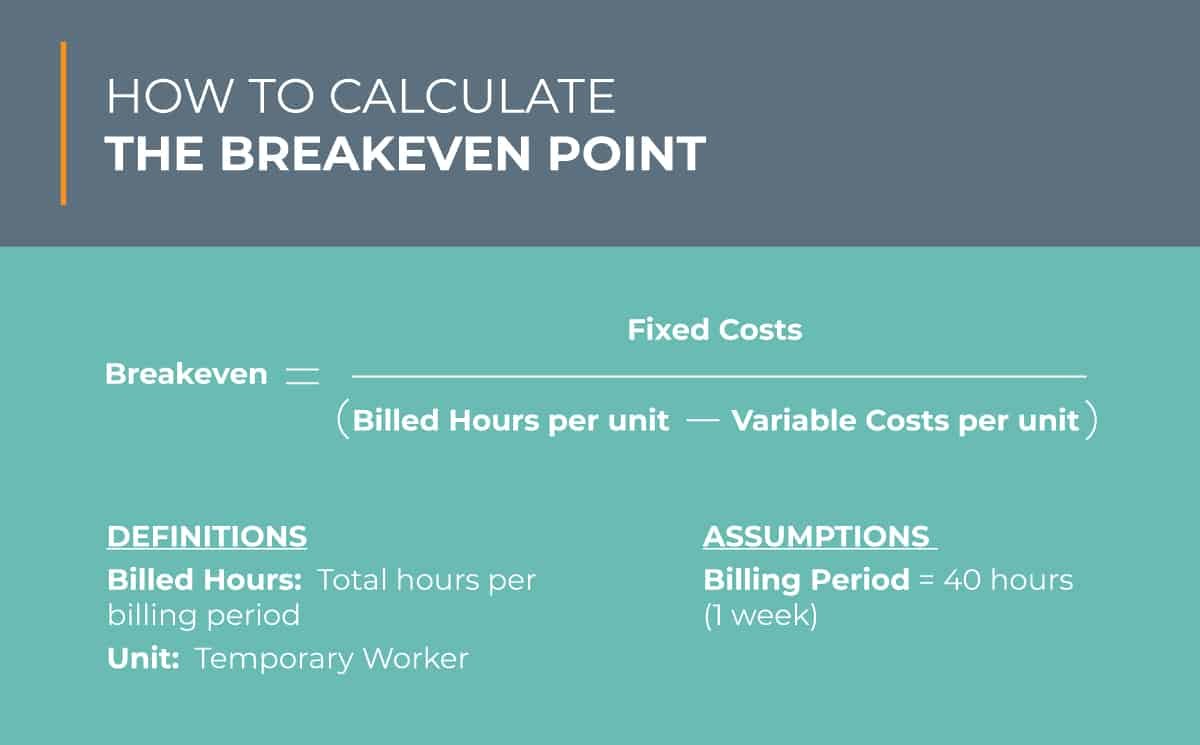

The Core Calculation: Breaking Even on Your Investment

Now for the main event: figuring out how much you need to spend to justify that $130 annual fee. There are two critical breakeven points to consider: covering the additional cost of the Executive membership and covering the full cost.

Breakeven Point #1: Justifying the Extra $65

Most members comparing the Executive tier already have a basic Gold Star membership or would otherwise opt for one. The real question then becomes, "Is the extra $65 for the Executive membership worth it?"

To cover the additional $65 cost:

- Calculate the target reward: You need to earn $65 in rewards.

- Apply the 2% reward rate: $65 / 0.02 = $3,250.

This means you need to spend $3,250 annually on qualified purchases to earn $65 back, effectively negating the extra cost of the Executive membership. Broken down monthly, that's roughly $271 to $300 in spending. If you regularly shop at Costco for groceries, household essentials, or even larger discretionary items, this figure is quite attainable for many households.

Breakeven Point #2: Covering the Entire $130 Fee Through Rewards

Perhaps you're starting fresh, or you want to see if the 2% reward alone covers the entire $130 Executive membership fee.

To cover the full $130 fee:

- Calculate the target reward: You need to earn $130 in rewards.

- Apply the 2% reward rate: $130 / 0.02 = $6,500.

In this scenario, you would need to spend $6,500 annually on qualified purchases to earn $130 back. This translates to approximately $542 per month. This higher threshold might be more challenging for single individuals or very light Costco users, but it's still well within reach for families or those who consistently do a significant portion of their shopping at the warehouse.

The Crucial Caveat: What Purchases Don't Count Towards Rewards

One of the most common pitfalls in calculating your breakeven point is assuming every dollar spent at Costco contributes to your 2% reward. This is simply not the case. Understanding these exclusions is vital for accurate planning.

Here’s a breakdown of purchases that typically do not qualify for the 2% reward:

| Category | Specific Items Excluded |

|---|---|

| Membership & Services | Membership fees themselves, Costco Shop Cards (gift cards), cell phones and plans. |

| Fuel & Tobacco | Gasoline, tobacco products. |

| Postage & Food Court | Postage stamps, food court purchases. |

| State-Specific | In some states, alcohol and prescription purchases are excluded. Always check local regulations. |

| Costco Travel (Specifics) | Surcharges, gratuities, trip protection, and resort charges associated with travel bookings. The base travel cost does qualify, but these add-ons do not. |

Why This Matters for Your Calculation

Let's say you spend $4,000 annually at Costco, but $1,000 of that is on gasoline. While that's $4,000 out of your pocket at Costco, only $3,000 would qualify for the 2% reward. In this example, your reward would be $60 ($3,000 x 0.02), which falls short of the $65 needed to cover the additional cost of the Executive membership.

This highlights why simply looking at your total credit card statement for Costco purchases isn't enough. You need to consider the nature of those purchases.

Beyond the Numbers: Valuing Non-Monetary Perks

While the 2% reward is concrete, the other benefits of Executive membership can hold significant, albeit harder-to-quantify, value. These "soft" benefits can absolutely influence your breakeven decision.

The $10 Monthly Delivery Credit: A Closer Look

That $120 annual credit for Same Day Delivery or Instacart orders sounds great, but remember the $150 minimum order requirement.

Ask yourself:

- How often do you use Costco delivery? If rarely, this benefit is practically zero for you.

- Do your delivery orders consistently meet or exceed $150? If you tend to make smaller, more frequent delivery orders, you might not qualify for the credit on every shop.

- What's the real value? If you use the delivery service anyway, this credit effectively reduces your delivery costs. If you wouldn't use delivery without the credit, then you need to weigh the convenience against the cost of items possibly being marked up on delivery platforms.

For someone who regularly spends $150+ on delivery orders, this $120 credit could almost fully cover the additional $65 fee (and then some) without even factoring in the 2% reward.

Early Shopping Access: Prioritizing Time and Serenity

Starting in 2025, Executive members get early entry. This isn't a cash-back benefit, but it addresses a common pain point for many shoppers: crowds.

Consider this:

- How much do you value avoiding crowds? If weekend shopping at Costco feels like an obstacle course, early access could save your sanity.

- What's your time worth? Getting in and out faster means more time for other things.

- Is it convenient? Can you actually take advantage of early hours, or are you typically a midday shopper anyway?

For some, the ability to shop in peace, particularly for high-demand items or during holiday seasons, could easily be worth more than $65 per year in improved experience alone.

Costco Travel: Maximizing Your Vacations

If you're a traveler, booking through Costco Travel already offers competitive pricing and often includes extra perks. The 2% reward on top of that makes it even more appealing for Executive members.

Think about your travel habits:

- Do you book packages, cruises, or rental cars often? Even one major trip annually could add thousands to your qualifying spending.

- Are you already using Costco Travel? If so, this is pure bonus. If not, it might be worth exploring for your next vacation.

A $5,000 family vacation booked through Costco Travel would yield an extra $100 reward, quickly chipping away at, or even covering, the Executive membership fee.

Your Personal Breakeven Calculation Strategy: A Step-by-Step Guide

Ready to get personal? The most accurate way to determine if an Executive membership is right for you is to look at your own spending habits.

Step 1: Gather Your Past Costco Spending Data

This is the most crucial step. You need a realistic picture of your historical purchasing.

- Check your Costco.com account: Log in to Costco.com, go to "My Account," and look for "Orders" or "Purchase History." You can often filter by date to see your last 12 months of online purchases.

- Review your credit card statements: If you primarily use one or two credit cards at Costco, tally up all your Costco charges for the past year.

- Call Member Services: If you can't find your data online, Costco Member Services (1-800-774-2678) can often provide an annual spending summary for your membership. This is often the most accurate way to get a total figure.

- Physical Receipts: As a last resort, if you keep receipts, you could manually add them up.

Pro-Tip: Focus on your last 12 months of spending. This gives you the most relevant data for predicting the next year.

Step 2: Subtract Non-Qualifying Purchases

Once you have your total spending figure, go back through and estimate (or calculate precisely, if possible) what portion of that spending was on excluded items.

- Gasoline: How much do you spend on gas at Costco annually?

- Gift Cards/Shop Cards: Did you buy any Costco gift cards for others (or yourself)?

- Tobacco/Alcohol/Prescriptions: If applicable to your state, estimate these purchases.

- Food Court: This is usually a smaller amount, but if you're a frequent hot-dog-and-soda person, count it.

Example: - Total spending last year: $4,500

- Estimated gas purchases: $700

- Estimated gift cards: $200

- Qualified spending: $4,500 - $700 - $200 = $3,600

Step 3: Calculate Your Potential 2% Reward

Multiply your qualified annual spending by 0.02.

Example (continuing from above):

- Qualified spending: $3,600

- Potential reward: $3,600 x 0.02 = $72

Step 4: Compare Your Potential Reward to the Breakeven Points

- Is your potential reward ($72) greater than the additional $65 cost? Yes! ($72 > $65).

- Is your potential reward ($72) greater than the full $130 cost? No! ($72 < $130).

Based on this example, the Executive membership would cover its additional cost and give you an extra $7 to spare.

Step 5: Factor in Other Benefits

Now, consider the value of the delivery credits, early shopping, and travel rewards.

Example:

- You determined your 2% reward would be $72.

- You typically use Costco Same Day Delivery twice a month, and your orders usually exceed $150. You'd likely utilize $20 of the $10 monthly credits, adding up to $240 annually in potential savings/value. However, the maximum you can gain from the credit is $120 (12 x $10). If you consistently use it, that's $120.

- So, your monetary value from the Executive membership could be $72 (reward) + $120 (delivery credit) = $192.

- Is $192 greater than the full $130 cost? Yes! ($192 > $130).

Even if your 2% reward doesn't cover the full fee, these other perks can easily bridge the gap and provide significant overall value.

Common Questions & Misconceptions About Executive Membership

Let's clear up some frequently asked questions and common misunderstandings to ensure your calculations are spot-on.

"When do I get my 2% reward?"

Your 2% reward certificate is mailed with your annual membership renewal notice, typically about 2-3 months before your renewal date. It's not an instant discount at checkout. The certificate must be redeemed for merchandise at a Costco warehouse; it cannot be used at gas stations or food courts, nor can it be cashed out (except in specific states like California, where by law, any reward certificate under $10 can be cashed).

"Does the 2% reward apply to online purchases?"

Yes, qualified purchases made on Costco.com and through Costco Business Centers (online and in-store) do count towards your 2% reward, just like in-warehouse purchases.

"What if I upgrade mid-year?"

If you upgrade to Executive membership mid-year, your 2% reward will be calculated from the date of your upgrade to your next renewal date. You'll also pay a prorated amount for the Executive membership for that initial partial year.

"What if I downgrade from Executive membership?"

If you downgrade from Executive membership, any earned 2% reward from your last renewal date until the downgrade will still be issued at your next renewal. However, you'll no longer accrue rewards after the downgrade date.

"Can I return the Executive membership if it doesn't pay off?"

Costco has a very generous satisfaction guarantee on memberships. If you're not satisfied, you can cancel your membership at any time for a full refund of your membership fee. This offers a low-risk way to try out the Executive tier for a year.

"Do all my family's purchases count towards my 2% reward?"

Yes, purchases made by anyone on your primary membership (including your spouse or household member who has a card under your account) count towards your single 2% reward certificate. It's a cumulative reward for the entire household or business tied to that primary membership number.

Making the Smart Choice: A Decision Framework

Ultimately, deciding whether to upgrade to Executive membership boils down to a personal financial assessment. Here's a framework to help you decide:

- Calculate Your Monetary Breakeven:

- Start with the minimum: Can you reliably spend $3,250 annually on qualified purchases? If yes, the Executive membership at least pays for its extra cost.

- Consider the full fee: Can you reliably spend $6,500 annually on qualified purchases? If yes, the 2% reward alone fully covers your Executive fee.

- Include delivery credits: If you realistically utilize the $10 monthly delivery credit (meeting the $150 minimum), add $120 to your potential savings/rewards. This alone can justify a significant portion of the fee.

- Quantify Non-Monetary Value:

- Early shopping: How much is avoiding crowds worth to you? Is it a significant factor in your shopping experience?

- Costco Travel: Do you book travel through Costco, and would the 2% reward further incentivize this?

- Risk Assessment:

- Costco's refund policy makes trying the Executive membership relatively risk-free. If after a year you find it didn't pay off, you can cancel and get your fee back.

- Future Spending Projections:

- Are there any significant purchases you anticipate making at Costco in the next year (e.g., appliances, electronics, furniture, a vacation)? These can quickly push you over the breakeven point.

- Are your shopping habits likely to change? (e.g., growing family, new home, starting a small business).

Your Next Steps: Actionable Advice

Now that you have the tools and understanding to accurately calculate your breakeven point, it's time to take action:

- Get Your Data: Seriously, log into Costco.com or call Member Services. Get that precise annual spending figure.

- Do the Math: Subtract exclusions, calculate your potential 2% reward, and compare it to both the $65 and $130 breakeven points.

- Value the Perks: Realistically assess how much you'd use and benefit from the delivery credits, early shopping, and travel rewards.

- Make Your Decision: If your total calculated value (2% reward + other benefits) comfortably exceeds the $130 annual fee, the Executive membership is a smart move for you. If it's a close call, consider trying it for a year, knowing you have Costco's generous refund policy as a backup.

By thoughtfully Calculating Your Breakeven Point for Executive Membership, you're not just saving money; you're becoming a smarter, more confident shopper who truly maximizes the value of every dollar spent. Happy shopping!